Third-quarter 2019 results from IPC’s Pulse of the Electronics Industry global data service show that the global electronics industry continues to thrive in a positive business environment and still predicts continued growth over the next year. The results are somewhat less optimistic than in earlier quarters this year and there are some sharp contrasts between regions.

The industry’s view of the current direction of the business environment worldwide remained positive this quarter but just barely. The composite score on the current state fell to its lowest level since the Pulse survey began in mid-2017.

Most participating companies reported the current direction for sales, orders and order backlogs as moving in a positive direction but with less strength than in previous quarters. Meanwhile, while rising labor and material costs and recruiting challenges continued to affect the business environment negatively. Yet, some regional results deviated from that pattern this quarter. Ease of recruiting, which has typically had a negative impact on the current business environment, is now having a net positive impact according to participating companies in Asia. The direction of profit margins has been positive for most segments this year, but it shifted to a mildly negative factor this quarter for companies in the Americas, indicating that margins are shrinking.

The companies’ average outlook for the next six months remains solidly positive on a global level but has weakened since the beginning of 2019. Europe is the only region reporting a net negative composite score on the industry’s six-month outlook. In the six-month outlook for Asia, only exports were rated as a negative driver this quarter, due to the trade war between China and the U.S.

The 12-month business outlook as of third quarter 2019 remains strong globally, with 87 percent of responding companies indicating a positive outlook. Only Europe reported a mixed outlook, reflecting the current uncertainty about the impact of Brexit and the region’s slowing economic growth.

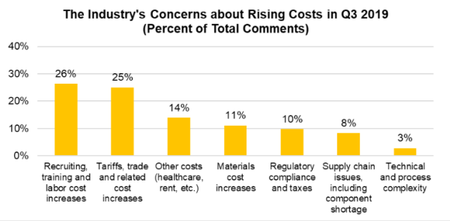

Respondents comment every quarter on the trends or conditions that are driving or limiting their business growth and where they are seeing significant cost increases. Based on this quarter’s comments, economic and market demand growth is the main driver of their sales growth. Of the conditions limiting growth, the number-one driver is workforce issues, followed closely by tariffs and regulatory issues. The component shortage still gets a few mentions, but it appears to have eased. The industry’s biggest concern about rising costs is in recruiting, training and labor costs, followed closely by tariffs and trade-related costs.

The fourth-quarter 2019 survey will be online October 1 with a deadline of October 18. The confidential survey is brief and easy to answer for company executives with broad knowledge of their companies’ performance. All eligible participants who complete the survey by the deadline will receive the report on the findings. More information is at www.ipc.org/IndustryData.

IPC (www.IPC.org) is a global industry association based in Bannockburn, Ill., dedicated to the competitive excellence and financial success of its 5,600 member-company sites which represent all facets of the electronics industry, including design, printed board manufacturing, electronics assembly and test. As a member-driven organization and leading source for industry standards, training, market research and public policy advocacy, IPC supports programs to meet the needs of an estimated $2 trillion global electronics industry. IPC maintains additional offices in Taos, N.M.; Washington, D.C.; Atlanta, Ga.; Brussels, Belgium; Stockholm, Sweden; Moscow, Russia; Bangalore and New Delhi, India; Bangkok, Thailand; and Qingdao, Shanghai, Shenzhen, Chengdu, Suzhou and Beijing, China.

»

»